Auditing, Tax Consultancy & Accounting Services

Grow your business with Us

Our Services

From Finance to Business Growth

Ready to Thrive in the UAE Market?

Contact us today at +971 4262 0555 or contact@fandeez.com. Let’s discuss how our services can add value and propel your business forward.

One-Stop Solution for Launching and Growing Your UAE Business

Fandeez simplifies navigating the complexities of starting and managing a business in the UAE. We offer a comprehensive suite of services to handle everything from initial setup to ongoing operations, ensuring you focus on your core business activities.

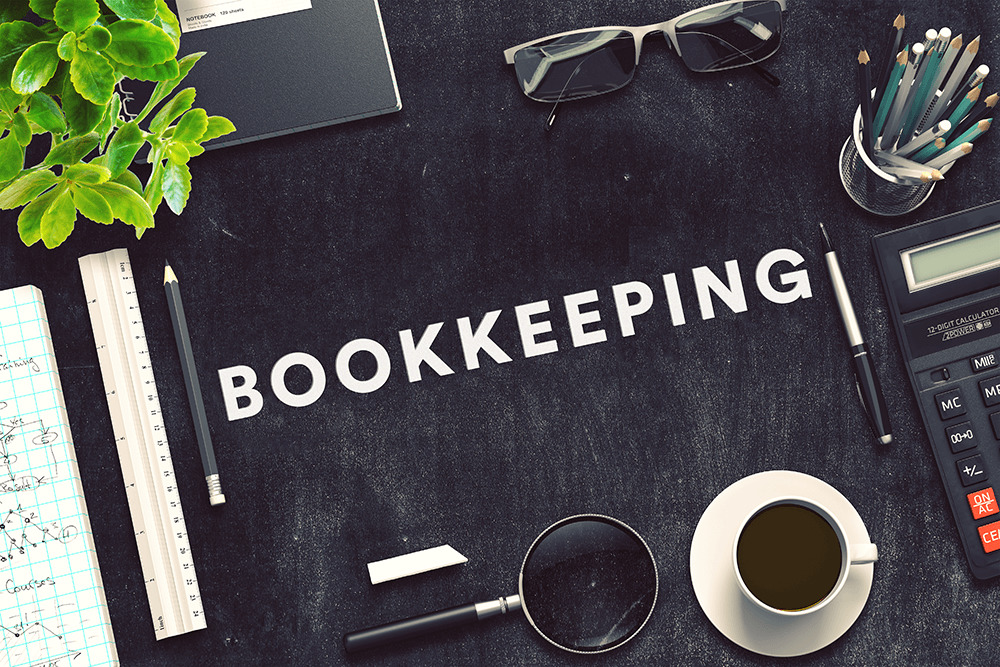

Forget the Full-Time Accountant - Embrace Affordable Accounting Solutions!

Running a small business in the UAE is exciting, but managing finances and complying with VAT (Value Added Tax) and CT (Corporate Tax) regulations can be a headache. Here’s how Fandeez can help:

The Problem: Hiring a full-time accountant can be expensive.

The Solution: Fandeez offers affordable outsourced accounting and bookkeeping services, perfect for all businesses.

Benefits

- Save Money: No visa costs, salaries, allowances, gratuity, or paid leave.

- Minimize Errors: Our professionals ensure accuracy and reduce financial risks.

- Expert Guidance: Qualified accountants handle all your accounting and tax needs.

- Customized Solutions: We tailor our services to your unique business requirements.

- VAT & CT Compliance: Fandeez keeps your bookkeeping compliant with UAE regulations.

Focus on Your Business, We’ll Handle the Rest:

Don’t let accounting burdens hold you back. Fandeez takes care of everything, allowing you to focus on growing your business

Those Who Trust US!